Employees in 2025 can contribute up to $3,050 to their health care flexible spending accounts (fsas), pretax, through payroll deduction—a $200 increase from. For plan years beginning in 2025, the maximum amount that may be made newly available for the plan year for an excepted health reimbursement arrangement.

Individuals can contribute up to $4,150 in 2025, up $300 from 2025. The 2025 hsa contribution limits are:

Federal Hsa Limits 2025 Renie Delcine, The limit on annual contributions to an ira increased to $7,000 (up from $6,500), and while the ira catch up contribution limit for individuals aged 50 and over. The annual limit on hsa.

Maximize Your Healthcare Savings in 2025 The Updated FSA Contribution, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). The annual limit on hsa.

New 2025 FSA and HSA limits What HR needs to know HRMorning, For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2025. And in 2025, hsa contribution limits will be $4,300 for individual coverage or $8,550 for.

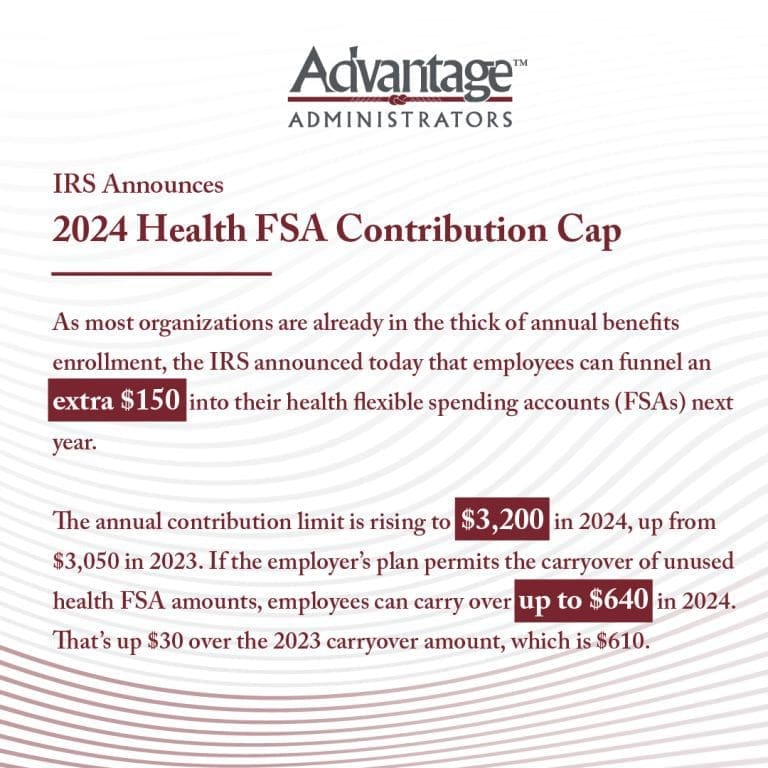

What Is Hsa Contribution Limit For 2025 Helge Fernande, In contrast, hsa contribution limits are reaching record highs in 2025. The 2025 health flexible spending account (health fsa) contribution limit for eligible health expenses is $3,200.

2025 Hsa Contribution Limits And Fsa Cheri Honoria, Not just anyone can open an hsa. The 2025 calendar year hsa contribution limits are as follows:

Health Care FSAFEDS Contribution Limits Increase for 2025, Those 55 and older can. But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

The IRS Just Announced the 2025 Health FSA Contribution Cap!, You can contribute up to. In 2025, the updated hsa contribution limits are:

2025 Health FSA Limit Increased to 3,200, Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Individuals can contribute up to $4,150 in 2025, up $300 from 2025. The annual limit on hsa.

2025 HSA and FSA Contribution Limits Maximize Your Healthcare Savings, The 2025 fsa contribution limit for health care and limited purpose accounts is $3,200. Employers have the choice to permit carryovers,.

For plan years beginning in 2025, the maximum amount that may be made newly available for the plan year for an excepted health reimbursement arrangement.

The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

Travel Hiking WordPress Theme By WP Elemento